prince william county real estate tax due dates 2021

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. 5p National Night Out.

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

During a meeting on Nov.

. Potomac Local News September 29 2021 at 631pm. Prince william county real estate tax due dates 2021 Wednesday March 2 2022 Edit. Ad Find Information On Any Prince William County Property.

How will i recieve my pets license and annual renewal notice. By mail to po box 1600 merrifield va 22116. Personal Property Taxes Due by Oct.

The assessments office mailed the 2021 assessment notices beginning march 9 2021. FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or Holiday the due date or deadline is the following business date. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

The extension applies to both commercial and residential real property. If you are searching by sale date please enter it in the following format. 17 2020 the Prince William Board of County Supervisors passed a resolution extending the payment deadline for real estate taxes for the second half of 2020 for 60 days.

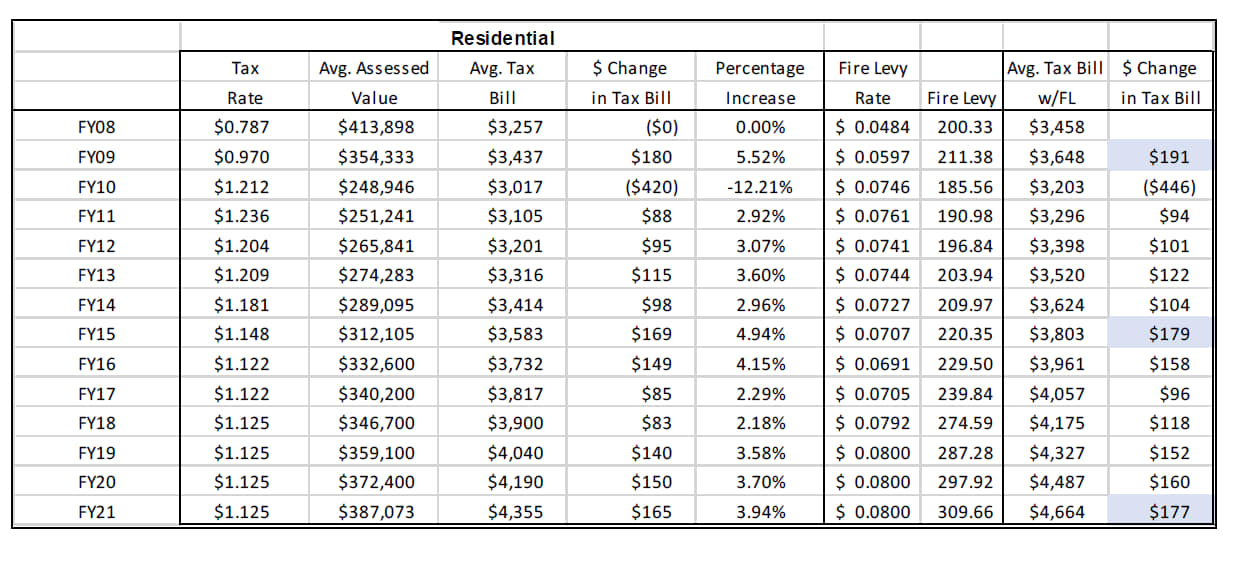

Real estate tax prince william county virginia. Second half of Real Estate Taxes Due Treasurers Office. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of.

Personal Property Tax Due Treasurers Office November 1. Every taxpayers levy. Personal Property Taxes Due.

State Income Tax Filing Deadline. Estimated Tax Payment 3 Due Treasurers Office October 5. Business License Renewals Due.

Personal Property Taxes and Vehicle License Fees Due. 5 2020 to Feb. Prince Georges County Maryland.

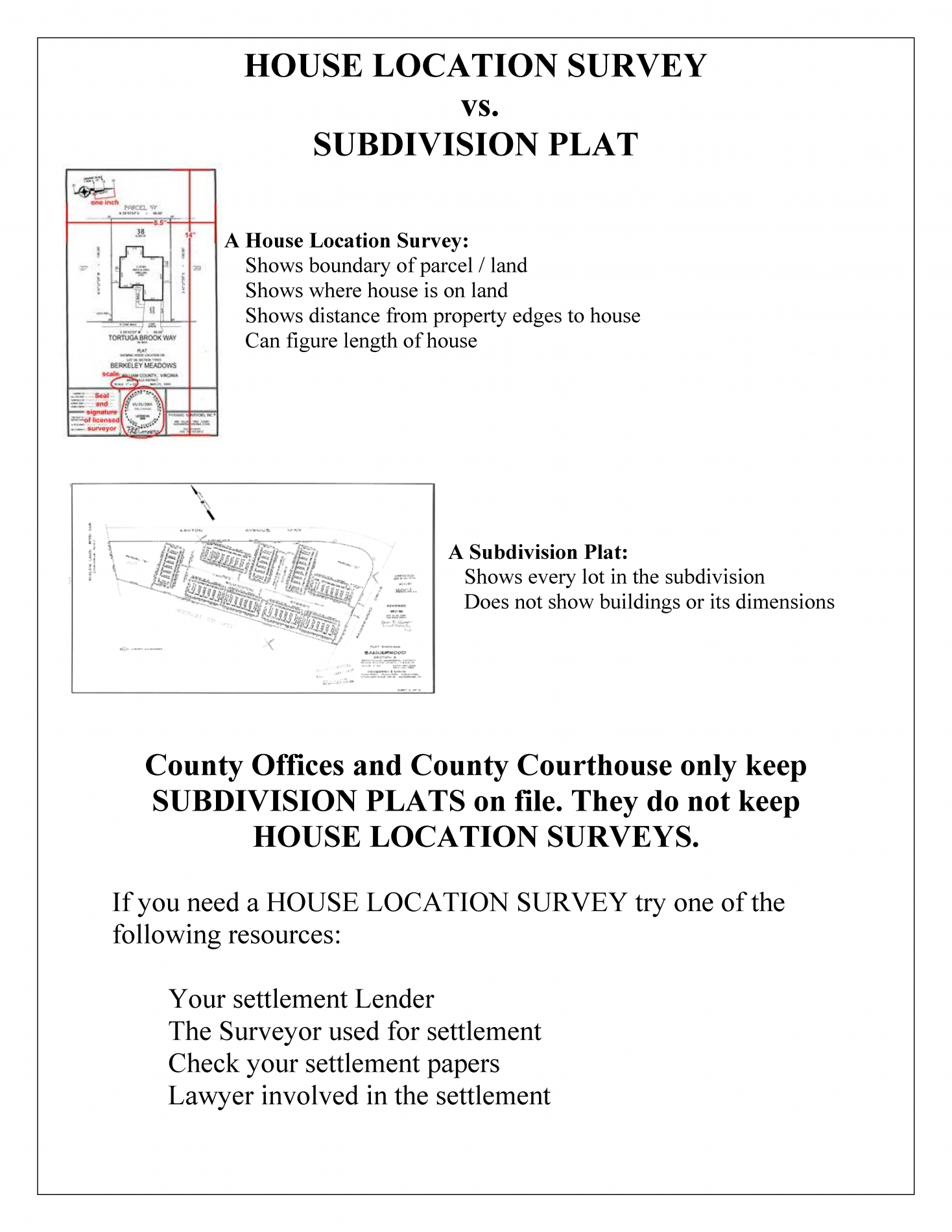

Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date. 12a Virginia Tax-Free Weekend. Other public information available at the real estate assessments office includes sale prices and dates legal descriptions.

Transient Occupancy Tax Filing. Prince william county real estate tax due dates. Second-half Real Estate Taxes Due.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. If the real. Business personal property filing deadline.

Please include original bill stub with payment to ensure timely posting to your property tax account 24 Hour Payment Slot located at front entrance or Walk-in Payments from 900 am - 100 pm Monday -. 830a Travel Field Hockey Registration for Girls in Grades 2 - 8. Scan Real County Property Records for the Real Estate Info You Need.

The deadline has been changed from Dec. Revalidation and New Land Use application Due Commissioner of the Revenues Office Kennel Tags on Sale Treasurers Office December 5. The second half are due by December 5 2022.

The 2022 first half real estate taxes were due July 15 2022. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Failure to often the BPOL by the control date tax id and schedule the fat tax concern that serve county or advantage will lose any revenue.

State Estimated Taxes Due Voucher 1 June 5. The due date for 2nd half 2021 real estate taxes is december 6 2021. From the Prince William County Government.

2021 Business Professional Occupational License 262 KB meals_tax_form_2022pdf 133 KB Adopted Tax Rates. December 5 annually Business Gross Receipts BPOL. Case dispositions or charge information may be researched by contacting the charging agency or the Clerk of the substantial court.

With due diligence examine your tax levy for all other possible errors. Provided by Prince William County Communications Office. Learn all about Prince William County real estate tax.

July 2 2022. If customers have not. The due date for 2nd half 2021 real estate taxes is december 6 2021.

You do still have to pay to Prince William County. Arlington County is a county in the Commonwealth of Virginia often referred to simply as Arlington or Arlington VirginiaThe county is situated in Northern Virginia on the southwestern bank of the Potomac. 4379 ridgewood center drive suite 203 prince william va 22192.

Accessory items except for backpacks are not included. Prince William County personal property taxes for 2021 are due on October 5 2021. 630p Prince George County School Board Meeting.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. April 30 annually. 11a 22nd Annual Southern Knights Cruisers Veterans Car Bike Show 1100am - 500pm.

Landfill And Compost Facility Safety Guidelines

First Tee Prince William County Hosts Successful Benefit Golf Tournament

Prince William County Park Rangers New On Call Number Effective April 1 2022

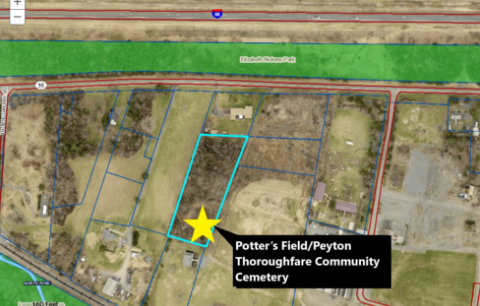

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Headlines Insidenova Com

Class Specifications Sorted By Classtitle Ascending Prince William County

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

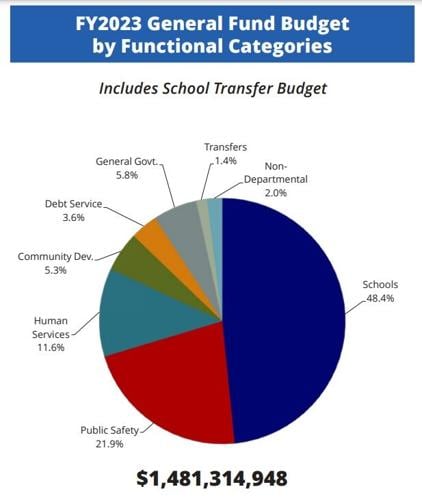

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living

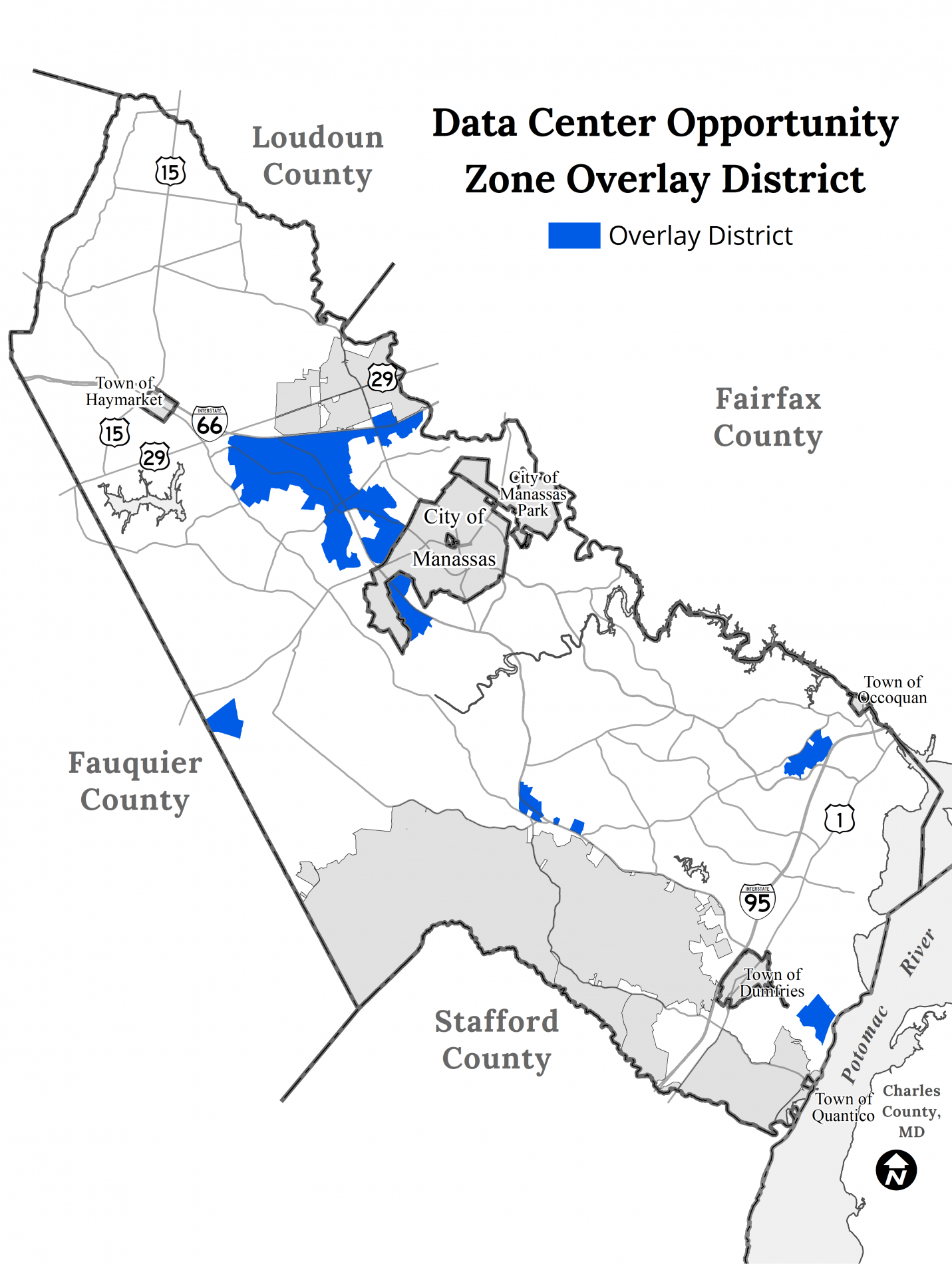

Second Rezoning Application Filed For Prince William S Digital Gateway Headlines Insidenova Com

New 800 Acre Data Center Campus Proposed In Prince William County Virginia Dcd

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William Board Of County Supervisors Commends George Mason University On Its 50th Anniversary

Prince William Wants To Hike Property Taxes Introduces Meals Tax